The Single Strategy To Use For Baron Tax & Accounting

Table of ContentsLittle Known Questions About Baron Tax & Accounting.The smart Trick of Baron Tax & Accounting That Nobody is Talking AboutThe Main Principles Of Baron Tax & Accounting The smart Trick of Baron Tax & Accounting That Nobody is DiscussingRumored Buzz on Baron Tax & Accounting

And also, bookkeepers are anticipated to have a decent understanding of maths and have some experience in an administrative function. To become an accountant, you need to have at least a bachelor's degree or, for a greater degree of authority and know-how, you can end up being an accountant. Accountants must also meet the rigorous needs of the accounting code of technique.

This guarantees Australian business proprietors get the best feasible monetary advice and administration possible. Throughout this blog site, we've highlighted the huge distinctions between accountants and accountants, from training, to duties within your company.

What Does Baron Tax & Accounting Mean?

The solutions they provide can make the most of earnings and support your financial resources. Companies and individuals need to think about accountants an important component of financial preparation. No accounting firm provides every service, so ensure your consultants are best fit to your details demands.

(https://old.bitchute.com/channel/eAxsUk31EkWH/)

Accountants exist to calculate and update the collection amount of cash every worker gets routinely. Keep in mind that vacations and illness impact pay-roll, so it's a component of business that you need to regularly upgrade. Retirement is also a significant element of pay-roll monitoring, specifically offered that not every worker will intend to be registered or be qualified for your business's retired life matching.

Baron Tax & Accounting Things To Know Before You Buy

Some lenders and capitalists need decisive, tactical choices in between the organization and shareholders complying with the conference. Accounting professionals can likewise be existing below to aid in the decision-making process.

Local business typically encounter one-of-a-kind economic difficulties, which is where accounting professionals can give vital assistance. Accounting professionals supply a series of services that aid companies remain on top of their financial resources and make notified decisions. Accountants likewise make sure that services conform with financial policies, taking full advantage of tax financial savings and reducing mistakes in economic records.

Hence, professional accounting helps prevent expensive blunders. Pay-roll monitoring involves the management of employee earnings and salaries, tax deductions, and advantages. Accounting professionals ensure that employees are paid properly and in a timely manner. They compute payroll tax obligations, handle withholdings, and ensure conformity with governmental regulations. Handling incomes Taking navigate to these guys care of tax filings and payments Tracking employee benefits and deductions Preparing pay-roll records Proper pay-roll management protects against issues such as late repayments, wrong tax filings, and non-compliance with labor legislations.

Baron Tax & Accounting Can Be Fun For Anyone

Little company owners can count on their accountants to deal with complicated tax obligation codes and policies, making the declaring process smoother and more reliable. Tax obligation planning is an additional necessary solution offered by accountants.

These services often concentrate on business appraisal, budgeting and projecting, and capital administration. Accountants help local business in determining the well worth of the business. They analyze properties, obligations, income, and market problems. Methods like,, and are utilized. Precise appraisal aids with selling the business, protecting lendings, or attracting investors.

Guide business proprietors on ideal practices. Audit support assists services go with audits efficiently and efficiently. It reduces tension and mistakes, making certain that services fulfill all essential policies.

By establishing reasonable economic targets, businesses can allot sources effectively. Accountants overview in the execution of these approaches to guarantee they line up with the organization's vision.

The Best Guide To Baron Tax & Accounting

They aid in establishing internal controls to avoid fraud and mistakes. In addition, accounting professionals recommend on compliance with legal and regulative demands. They guarantee that services comply with tax obligation laws and industry guidelines to avoid charges. Accounting professionals likewise recommend insurance policy plans that provide protection against possible threats, making sure business is protected versus unexpected occasions.

These tools help local business maintain accurate documents and enhance procedures. is commended for its thorough features. It aids with invoicing, pay-roll, and tax prep work. For a free choice, is recommended. It supplies several functions at no charge and is suitable for start-ups and tiny businesses. stands apart for convenience of use.

Val Kilmer Then & Now!

Val Kilmer Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Marques Houston Then & Now!

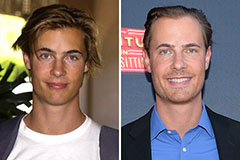

Marques Houston Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Dawn Wells Then & Now!

Dawn Wells Then & Now!