Pvm Accounting Fundamentals Explained

Table of ContentsPvm Accounting for BeginnersSee This Report on Pvm Accounting7 Simple Techniques For Pvm AccountingThe Ultimate Guide To Pvm AccountingPvm Accounting Fundamentals ExplainedPvm Accounting Things To Know Before You Get This

Make certain that the bookkeeping process abides with the law. Apply needed construction accountancy criteria and procedures to the recording and reporting of building activity.Understand and preserve conventional expense codes in the accountancy system. Interact with various financing firms (i.e. Title Firm, Escrow Business) concerning the pay application process and demands needed for payment. Manage lien waiver disbursement and collection - https://moz.com/community/q/user/pvmaccount1ng. Display and solve financial institution issues including fee abnormalities and check differences. Aid with implementing and maintaining internal monetary controls and treatments.

The above statements are planned to explain the basic nature and degree of work being carried out by people designated to this category. They are not to be taken as an exhaustive list of obligations, responsibilities, and skills required. Personnel may be needed to perform responsibilities outside of their regular responsibilities every so often, as required.

What Does Pvm Accounting Mean?

Accel is looking for a Building Accounting professional for the Chicago Workplace. The Building and construction Accountant does a variety of accounting, insurance compliance, and job administration.

Principal tasks include, yet are not limited to, dealing with all accounting functions of the company in a timely and precise way and supplying records and schedules to the company's certified public accountant Firm in the prep work of all financial statements. Makes sure that all audit treatments and features are managed precisely. Accountable for all economic records, payroll, banking and daily procedure of the accounting feature.

Prepares bi-weekly trial equilibrium reports. Works with Project Supervisors to prepare and upload all month-to-month invoices. Procedures and concerns all accounts payable and subcontractor repayments. Produces regular monthly recaps for Workers Compensation and General Responsibility insurance costs. Produces regular monthly Job Cost to Date records and functioning with PMs to resolve with Task Managers' spending plans for each job.

The 10-Minute Rule for Pvm Accounting

Proficiency in Sage 300 Building and Realty (previously Sage Timberline Office) and Procore building administration software program a plus. https://hub.docker.com/u/pvmaccount1ng. Must additionally be skilled in various other computer software systems for the prep work of reports, spreadsheets and various other accounting analysis that might be needed by administration. construction bookkeeping. Have to possess solid organizational skills and capability to focus on

They are the economic custodians who ensure that building projects remain on spending plan, abide by tax laws, and preserve financial transparency. Building and construction accounting professionals are not simply number crunchers; they are strategic partners in the building procedure. Their main duty is to manage the monetary facets of building and construction projects, making sure that resources are assigned effectively and economic dangers are minimized.

Some Known Details About Pvm Accounting

They function very closely with task supervisors to produce and monitor budgets, track expenditures, and forecast economic demands. By preserving a tight grip on task finances, accounting professionals assist protect against overspending and monetary problems. Budgeting is a cornerstone of effective construction tasks, and building and construction accountants contribute hereof. They create in-depth spending plans that incorporate all project costs, from materials and labor to authorizations and insurance coverage.

Browsing the complex internet of tax policies in the building and construction market can be difficult. Building and construction accountants are skilled in these policies and make sure that the task abides with all tax obligation needs. This includes handling payroll tax obligations, sales taxes, and any type of other tax obligations specific to building and construction. To master the duty of a building and construction accountant, people need a solid instructional foundation in accounting and finance.

Additionally, qualifications such as Certified Public Accountant (CPA) or Certified Construction Market Financial Expert (CCIFP) are extremely concerned in the market. Building and construction jobs often entail limited due dates, altering policies, and more info here unanticipated expenses.

The Ultimate Guide To Pvm Accounting

Ans: Construction accountants produce and monitor budgets, identifying cost-saving chances and making certain that the job stays within budget plan. Ans: Yes, building and construction accounting professionals handle tax obligation compliance for building tasks.

Introduction to Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make hard selections among numerous monetary alternatives, like bidding on one job over another, selecting financing for products or equipment, or setting a project's profit margin. Building is a notoriously unpredictable market with a high failing rate, slow time to settlement, and irregular money flow.

Manufacturing includes repeated procedures with quickly recognizable expenses. Production calls for different processes, products, and devices with varying prices. Each job takes place in a new place with differing site problems and special obstacles.

Some Known Factual Statements About Pvm Accounting

Constant usage of different specialty professionals and vendors affects effectiveness and money flow. Settlement gets here in complete or with routine repayments for the complete agreement amount. Some portion of repayment may be withheld until task completion also when the service provider's work is completed.

While conventional producers have the advantage of regulated settings and optimized production procedures, building business have to continuously adjust to each new task. Also somewhat repeatable tasks call for alterations due to site problems and various other aspects.

Luke Perry Then & Now!

Luke Perry Then & Now! Angus T. Jones Then & Now!

Angus T. Jones Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Robbie Rist Then & Now!

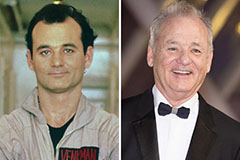

Robbie Rist Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!